Call Now: (+61) 416-195-006

ACCT 6004 GROUP CASE STUDY ASSIGNMENT

Activity 3: Job Order Costing and Ethics in J&B Sports

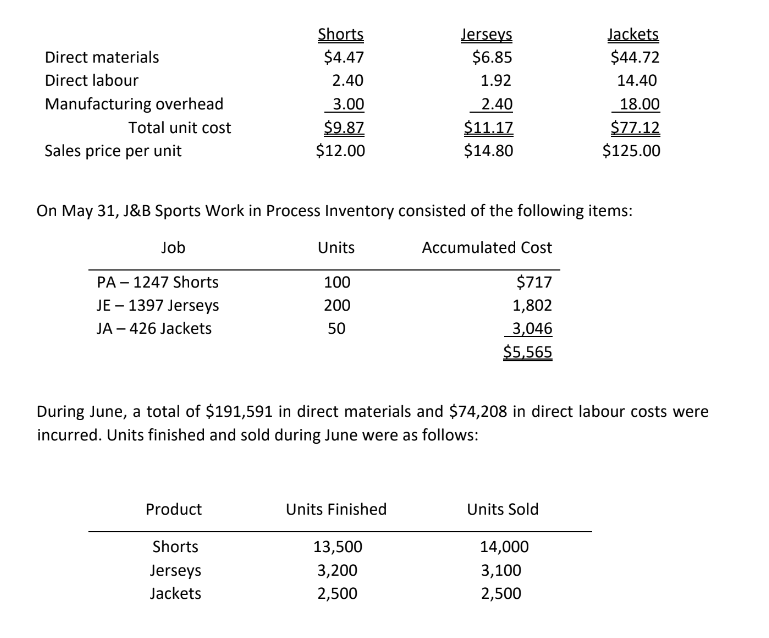

J&B Sports custom makes soccer tops (jerseys), shorts, socks and jackets for individual clubs and players within the clubs. Players order their name and selected number on the back of each jersey. Clubs also have specific requirements regarding the sponsors’ logos which need to be added to the clothing. The kits are manufactured in batches and product costs are accumulated for each batch or job. When the job is completed, the total costs accumulated for the job are divided by the number of units produced to determine the average cost per

unit.

J&B Sports has determined the following unit costs for three of its four products:

Required:

d. J&B Sports board of directors has adopted a long-term strategy of maximising value of the shareholders’ investment. To achieve this goal, the board established the following five-year financial objectives:

• Increase sales by 10% per year

• Increase income before taxes by 15% per year

• Increase dividends by 12% per year.

The managing director added a fourth financial objective last year: maintaining cost of goods sold at a maximum of 70% of sales. The company failed to achieve this goal in the year ending 1 February 2019, and it appears that it will again not be achieved in the current year. Because employee bonuses are tied to performance on all four objectives, the new internal accountant is concerned about company morale. She decides that if she overestimates the amount of ending work in process inventory and reclassifies the fabric inspection costs as administrative rather than manufacturing overhead costs, cost of goods sold for the year will fall below the 70% maximum level. She makes the adjustments and presents the managing director a set of financial statements that meet most of the financial objectives.

i. Explain why the adjustments the accountant made are unethical, referring to the Australian Accounting code of ethics.

ii. What additional costs, both monetary and nonmonetary might J&B Sports incur because of the accountant’s actions?

Expert's Answer

Chat with our Experts

Want to contact us directly? No Problem. We are always here for you