Call Now: (+61) 416-195-006

Task C

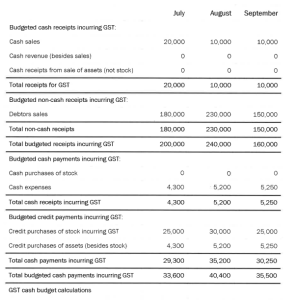

Soon you will need to prepare a Business Activity Statement (BAS) for the first quarter on 2012/13.

Complete the following.

1. State how many years you will need to keep GST records in order to satisfy ATO

requirements. 2. Complete the GST budget on the following page to anticipate GST liability.

a) Cash receipts

b) Cash payments

c) GST liability

Expert's Answer

Chat with our Experts

Want to contact us directly? No Problem. We are always here for you